In this post we will learn how to analyze Support and Resistance in Option Chain NSE and individual Stock onparticular strike price through Put/Call OI (open interest) by option chain analysis, here we taking Nifty 50 index option chain for example, through Put option we will find out the support of index and through Call option we will identify the resistance of index.

Option Strategy for Call and Put :

| Important Terms in Option chain | Description |

| OI | OI is an abbreviation for Open Interest. It is a data that signifies the interest of traders in a particular strike price of an Option. OI tells you about the number of contracts that are traded but not exercised or squared off. The higher the number, the more is the interest among traders for the particular strike price of an Option. And hence there is high liquidity for you to able to trade your Option when desired. |

| Change in OI | It tells you about the change in the Open Interest within the expiration period. The number of contracts that are closed, exercised or squared off. A significant change in OI should be carefully monitored. |

| IV | Implied Volatility in option chain tells the potential move in Stock/Index price, high IV means premium would be high because of a potential move in price. |

| LTP | Last Traded Price |

| Net Chng | Net chng shows premium deviation from LTP |

| Strike Price | is the price at which you as a buyer and seller of the Option agreed to exercise the contract. Your Options trade will become profitable only when the price of an Option crosses this strike price. |

| Expiry Date | Expiry date is the last date of the option contract on which option holder exercise it according to terms and condition, mainly there will be 3 expiry date of 1 month each ( Near, Next and Far) |

| In-The-Money (ITM) | A call option is in ITM if its strike price is less than the current market price of the underlying asset. A put option is ITM if its strike price is greater than the current market price’ of the underlying asset. |

| At-The-Money (ATM) | When the strike price of a Call or Put option is equal to the current market price of the underlying asset then it is in ATM. |

| Over-The-Money (OTM): | A call option is OTM if the strike price is greater than the current market price of the underlying asset. A put option is OTM if the strike price is less than the current market price of the underlying asset. |

The support level of Index :

Put option OI helps to understand the support of nifty index means its an only analysis that traders believes the market will go up and will be remain closed above from a particular strike price then traders Write/Sell/Short Put option at that strike price, and when a particular strike price having a huge number of OI by Short Buildup in Put option in comparing other strikes then that strike price would be identified as a support level of Index.

The resistance level of Index:

Call option OI helps to understand the resistance of nifty index means its an only analysis that traders believes the market will go down and will be remain closed below from a particular strike price then traders Write/Sell/Short Call option at that strike price, and when a particular strike price having a huge number of OI by Short Buildup in Call option in comparing other strikes then that strike price would be identified as a resistance level of Index.

Once you find support and resistance level of Index then you can find the high and low boundary of Index, like example if Nifty Index strike price 10000 having a huge number of OI (OI + Change in OI ) than other strikes for Put option being identified as strong support and strike price 10800 having a huge number of OI (OI + Change in OI ) than other strikes for Call option being identified as a strong Resistance.

Put Call Ratio in option chain:

PCR Put Call Ratio of option chain in the derivative market will explain the market sentiment of traders. The put-call ratio is a measurement that is widely used by investors to gauge the overall mood of a market. Put writers/sellers writes put when he believes the market will go up and he expects a bullish scenario in the market, and other side Call writers/sellers write Call when he believes the market will have resistance to go up and he believes slowness/bearish scenario in the market.

Basic Understanding of Put-Call Ratio : The put-call ratio is calculated by dividing the number of traded put option contracts by the number of traded call option contracts.

PCR = Total Puts / Total Calls

Conclusion:

Most probably market would be bounded within range 10000 to 10800, as per the image above I would like to say that this is a very big range and the market is in downfall, traders not having interest to Write near ATM Put option and having strong resistance near ATM through Call option.

To Open DMAT Account Click Below

Straddle strategy in options trading :

Straddle strategy is very common strategy in option trading, in this technic call option and put option are at same strike prices, as stated in below image, if you want to make this spread below link.

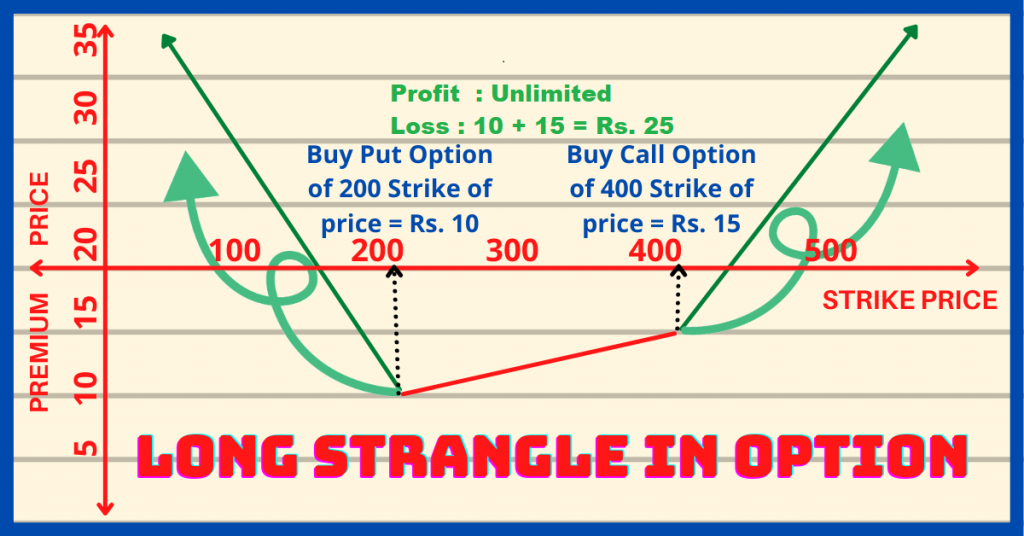

Strangle Strategy in Option Trading :

Strangle is the profitable strategy in option trading, it is similar to a long straddle but only the difference is call option and put option are at different strike prices in a long strangle. To make this spread follow below link.

Best ROBO Trading software in india | Royal Q Binance review

बाजार अब कहीं भी हो लेकिन होगा सिर्फ फायदा